In 2022, RLC achieved record profitability and surpassed pre-pandemic business levels ahead of industry expectations. Strategic investments, agile innovation, and financial discipline propelled the Company forward in a fully reopened economy. Despite inflationary pressures and supply chain challenges, RLC still delivered strong results and consolidated its position as one of the Philippines’ leading diversified real estate companies.

Revenues and profit reached their highest levels in the Company’s history. RLC generated consolidated revenue of Php45.50 billion to grow by 25% on the back of the significant recovery of the Company’s investment portfolio, improved revenue recognition of residential sales, and the continued success of the Chengdu Ban Bian Jie project in China. EBITDA rose 29% to Php19.35 billion, pushing overall EBIT up by 45% to Php14.11 billion. Net income attributable to the parent registered at Php9.75 billion, 21% higher than last year’s income, and 12% better than in 2019.

RLC maintained its strong financial position with Total Assets of Php223.44 billion, which includes cash of about Php8.28 billion. Shareholders’ Equity settled at Php135.45 billion, net of Php2.57 billion in Treasury Shares from the Company’s share buyback program, which commenced in November 2021. Its liquidity position remained intact following a Php15-billion bond offering in August, which obtained the highest credit rating of “PRS Aaa with a stable outlook” and oversubscribed by 12 times the base offer. Total debt outstanding as of December 2022 ended at Php51.16 billion for a net gearing ratio of only 33%, while Earnings per Share reached Php1.91, 23% higher than last year and 14% better than the pre-pandemic record.

The stability and strength of our business allowed us to return value to shareholders through Php2.55 billion in cash dividends and Php2.57 billion in share repurchases, signaling our confidence in RLC’s intrinsic value and growth prospects.

Business Results

Increased consumer spending and the permanent easing of restrictions fueled broad-based growth across our businesses. The execution of our integrated strategies in the face of cost headwinds resulted in strong sales, robust cash flows, and solid earnings growth.

Investment Portfolio

With the resurgence in foot traffic and normalized rental rates, Robinsons Malls accounted for 29% of company revenues at Php13.03 billion to surge by 58% versus 2021. EBITDA accelerated by 70% to Php6.59 billion, while EBIT ballooned by 1,484% to Php3.02 billion. In the 4th quarter, mall revenues surpassed the pre-pandemic record, growing by 54% compared to the same period last year.

Robinsons Malls strengthened its presence in North Luzon by opening Robinsons Place Gapan last November 30, 2022, in time for the festive holiday season. Conveniently located along the Pan-Philippine Highway in Gapan City, the full-service mall is easily accessible to progressive cities nearby, such as Palayan, the provincial capital, and Cabanatuan, Nueva Ecija’s most populous city. The 40,000-square-meter development is RLC’s second mall in the province of Nueva Ecija.

In addition, RLC completed the expansion wing of Robinsons Place Antipolo, adding 24,000 square meters of gross leasable space for a complete and elevated urban lifestyle experience. The expansion features an enticing mix of international and local retail shops, diverse food establishments, and other new amenities.

Robinsons Malls capped the year with gross leasable space of 1.59 million square meters and a system-wide occupancy rate of 91% across 53 operational lifestyle centers nationwide.

Sustaining its upward trajectory in 2022, Robinsons Offices posted revenues of Php7.06 billion to grow by 9% and contribute 16% to RLC’s topline. EBITDA and EBIT ended at Php6.20 billion and Php5.27 billion, respectively. This steady performance was driven by rental escalations in existing office developments, and the success of our leasing activities for new offices, namely Cybergate Galleria Cebu, Cybergate Bacolod 2, and Cybergate Iloilo Tower 2.

The addition of three (3) new office buildings bolstered RLC’s foothold in the provinces and expanded total leasable space by 8% to 741,000 sqm. Its growing portfolio of 31 high-quality office developments registered a system-wide leased percentage of 90% as of December 2022. Meanwhile, we continue to strengthen our portfolio of flexible workspaces under the brand work.able, which now has eight (8) operational sites and around 2,200 seats in Pasig City, Quezon City, and Taguig City.

Moreover, RLC demonstrated its commitment to growing its flagship real estate investment trust, RL Commercial REIT, Inc. (RCR), through two income-generating assets–Cybergate Bacolod and Cyberscape Gamma. These dividend-accretive assets will bolster RCR’s portfolio and increase shareholder value, while RLC maximizes capital recycling in support of various local real estate projects.

Buoyed by the global reopening of tourism and the resurgence of travel, Robinsons Hotels and Resorts (RHR) posted the fastest revenue growth among RLC’s businesses, accelerating by 94% to Php2.33 billion. Higher average room rates, increased F&B sales, and the resurgence of events positioned RLC’s hospitality business for a strong recovery. Despite the impact of pre-operating expenses from newly opened hotels, EBITDA improved by 13% to Php277 million. Depreciation of hotels opened in 2021 and 2022, however, pushed EBIT to a loss of Php225 million.

2022 was a transformational year for RHR as we continued to strengthen the foundation of one of the biggest and most diversified hospitality portfolios in the Philippines. We introduced Go Hotels Plus, an enhanced essential value brand featuring upgraded amenities and a refreshed signature look, with the opening of its first two properties in Tuguegarao and Naga. Situated next to Go Hotels Plus Naga is RHR’s newest Summit Hotel offering a wide range of options for recreation, dining, and memorable events. It has 60 spacious guest rooms composed of 56 deluxe rooms and 4 Summit Suites.

In addition, RHR unveiled Fili, the first authentic five-star Filipino hotel brand, at NUSTAR Integrated Resort in Cebu. Fili Hotel in NUSTAR brings together the finest hotel offerings with modern Filipino elements, featuring stunning views of the sea, mountain, and city skylines. It prides itself in its signature brand of Filipino hospitality, expressed in its genuine care, joyful nature, and efficient service. Aside from Fili Hotel, RHR operates five (5) specialty restaurants in Cebu’s premier luxury integrated resort – the world-famous Mott32, Cebu’s first Italian steakhouse Il Primo, Xin Tian Di, its signature Filipino restaurant Fina, and the Fili Lobby Lounge.

Robinsons Hotels and Resorts ended 2022 with over 3,600 keys across 24 company-owned hotel and leisure properties. Moreover, there are four (4) Go Hotels with 800 rooms under franchise agreements.

Capitalizing on growing demand and the rise of e-commerce, Robinsons Logistics and Industrial Facilities (RLX) continued to thrive as one of RLC’s fastest-growing businesses. In 2022, RLX registered a 57% increase in revenues to Php555 million from its seven (7) industrial facilities located in Sucat, Muntinlupa, Sierra Valley in Cainta, Calamba, Laguna, San Fernando, and Mexico, Pampanga. EBITDA and EBIT rose by 48% and 41% to Php479 million and Php351 million, respectively.

RLC’s Integrated Developments, on the other hand, recognized revenues of Php646 million from a portion of the sale of land in Bridgetowne Destination Estate to joint venture entities. EBITDA and EBIT closed at Php392 million and Php388 million, respectively.

Development Portfolio

RLC Residences and Robinsons Homes marked an exceptional year in 2022. The Company’s residential brands posted combined realized revenues of Php9.10 billion for a 44% growth year-on-year, driven by increased payment collection from buyers, the timely completion of residential projects, and significant contribution from joint venture equity earnings. EBITDA soared by 54% to Php3.51 billion, while EBIT escalated by 60% to Php3.41 billion.

For the year 2022, Robinsons Residences and Robinsons Homes reported a combined net pre-sale of Php16.96 billion, 57% higher than the previous year. This is primarily attributed to the strong launch performance of four (4) new residential projects, namely, SYNC N Tower, Sierra Valley Gardens Building 3, Woodsville Crest Pine in Parañaque, and AmiSa Private Residences Tower D. Net sales take-up from JV projects also expanded by 58% to Php8.99 billion from Php5.68 billion in 2021.

In pursuit of improving customer experience through technology, RLC Residences is developing the My RLC Home Super App, the first all-in-one mobile application for residential communities. Slated for official launch in the middle of 2023, the platform seeks to deliver convenience and seamless service to property buyers from purchase to move-in.

Finally, RLC recognized revenues of Php12.78 billion from Phase 2 of its Chengdu Ban Bian Jie project in China, following the turnover of units to buyers. With a few parking slots and shophouses still for sale, we have already sold 96% of the total project. Moreover, the Company has received US$24 million in cash dividends on top of the repatriation of 99.78% of its invested capital.

After the success of its first international venture, RLC has decided to focus its resources in the Philippines in pursuit of opportunities to elevate the Filipinos’ quality of life.

The Company spent a total of Php25.86 billion in capital expenditures in 2022 for the development of malls, offices, hotels, and industrial facilities, alongside the construction of residential projects, land acquisitions, and new investments for its domestic operations.

CREATING SHARED VALUE

Our robust financial results allowed us to invest in creating more value for all our stakeholders – our employees, customers, partners, shareholders, and the communities in which we are present. With this, the Company prioritized the integration of Environmental, Social, and Governance (ESG) programs into the broader corporate strategy, as part of its unwavering commitment to sustainability. As a result, we are innovating further and faster, taking action today to help shape a better tomorrow.

At the forefront of our ESG strategy is our commitment to reduce our environmental impact through renewable energy. RLC is proactively taking steps to accelerate the shift toward the use of greener sources of energy through rooftop solar panel installations in malls, and electricity supply generation from hydroelectric power plants in our office buildings. In addition, the Company continues to invest in sustainable developments that adhere to international green building standards. As a testament to this, Robinsons Giga Tower in the Bridgetowne Destination Estate received a Leadership in Energy and Environment Design (LEED) Gold certification while Robinsons Cyberscape Gamma in the Ortigas Center Business District became the Philippines’ first Excellence in Design for Greater Efficiencies (EDGE)-certified REIT building.

RLC also strives to enrich lives and uplift communities by sharing hope and providing assistance and opportunities to those in need. Through its corporate social arm, Robinsons Land Foundation, Inc. (RLFI), the Company pursues several social welfare programs for disaster response, community development, health & nutrition, and child welfare & education.

Furthermore, in recognition of its people as the Company’s most valuable asset, RLC maintained its focus on talent and skills development, as well as creating a culture of inclusivity. This year, we are honored to be recognized as one of ‘the Philippines’ Best Employers for 2023’ based on a study conducted by the Philippine Daily Inquirer and Statista, the world’s leading data and business intelligence portal. This signifies the Company’s efforts in shaping an environment where people are inspired to thrive and to live our purpose of building dreams.

WAY FORWARD

Robinsons Land capitalized on a recovering economy to build a stronger, broad-based momentum across its businesses. After almost three years of navigating a global health crisis, the Company forges ahead with confidence and optimism. In 2023, we will continue to invest in our diversified portfolio, expanding the breadth of our products and introducing customer-driven innovations, to deliver sustainable value in an ever-changing environment.

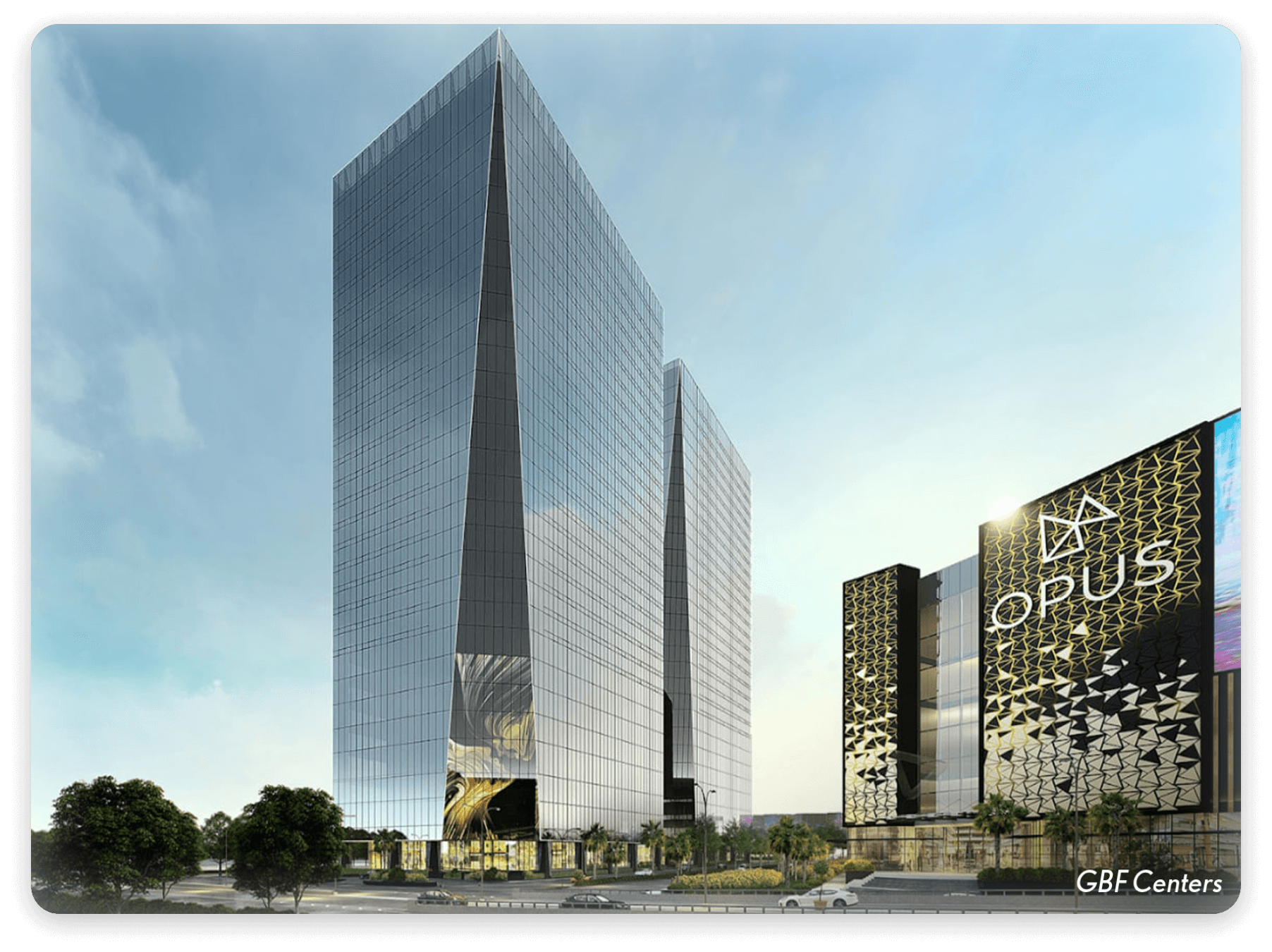

Robinsons Malls is poised to enhance its portfolio and elevate the shopping experience with the completion of Opus mall in the Bridgetowne Destination Estate. Opus is another RLC venture in a metropolitan high-end lifestyle center that will house a wide selection of international retail brands. Upon completion, Opus will increase total gross leasable space by 5% to 1.67 million square meters.

To boost its portfolio of high-quality office developments, Robinsons Offices will complete GBF Tower 1 in 2023. The state-of-the-art, Grade A office building will cater to both traditional and multinational corporations, in addition to BPO companies. Spanning 52,000 square meters of gross leasable space, GBF Tower 1 will feature world-class engineering and architectural designs, and sustainable green building components.

With the resurgence of international travel and tourism, Robinsons Hotels & Resorts (RHR) is expected to accelerate growth across its well-diversified brands. The Company will cater to the anticipated surge in demand with the launch of Westin Manila Sonata Place Hotel, RLC’s fourth international branded hotel, and the opening of remaining rooms in Go Hotel Plus Tuguegarao and Fili Hotel at NUSTAR. These will increase the room count by 18% for a total of 4,220 keys.

Demand for residential property remains robust, driven by growing demand from both domestic end-buyers and foreign investors. To capitalize on this momentum, RLC Residences and Robinsons Homes plan to introduce new upscale and high-end projects in ideal locations where Filipinos can live their best lives. In addition, we are looking forward to recognizing gains from our joint venture projects with renowned real estate developers Shang Properties Inc., Hongkong Land Properties, and DMCI Homes, as they begin to contribute substantially to the Company’s bottom line in 2023.

Meanwhile, Robinsons Logistics and Industrial Facilities (RLX) aims to become the fastest-growing logistics facility provider in the country with the addition of 60,000 sqm of gross leasable space in Calamba, Laguna, and Cainta, Rizal. Moreover, we will continue to make substantial progress in the development of our landmark Destination Estates – the 30-hectare Bridgetowne in Pasig and Quezon City, the 18-hectare Sierra Valley in Cainta, and the 200-hectare Montclair in Pampanga. These master-planned integrated developments will espouse the “Live, Work, Play, Inspire” lifestyle to empower a life of convenience and productivity.

As we have completed the deployment of proceeds from the IPO of RL Commercial REIT, Inc. (RCR), we have appropriated around Php20 billion for 2023 which will be funded through internally-generated cash from operations and borrowings. Our existing land bank in the Philippines has now reached over 800 hectares, which can support approximately 10 years’ worth of projects across our businesses.

With agility in execution, continued innovation, and the excellence of our people, RLC is well-positioned to drive meaningful growth in 2023 and beyond. We are prepared to execute our strategic priorities, and deliver on our purpose of building dreams and creating long-term value for our shareholders.

Acknowledgements

As we take on the road ahead from a position of strength, we would like to express our deepest gratitude to our Board for their ongoing guidance and encouragement. We are also grateful to our shareholders, business partners, patrons, customers, and communities for their continued trust and support.

Lastly, we would like to thank our employees for their invaluable contribution to the results and progress we have achieved.

RLC looks forward to the journey towards transformation and growth in the many years to come. Through it all, we will remain steadfast in our commitment to creating shared success for all our stakeholders.

Maraming salamat po.

LANCE Y. GOKONGWEI

Chairman

FREDERICK D. GO

President and CEO